WELCOME TO BILLMYWAY

Invoicing and Payment Solutionsto get you paidFaster

OUR MISSION

BillMyWay was founded in 2007 with a goal of making invoicing simple and easy to use. Our mission is to provide fast turnaround and low cost for all parties involved, Billers and Payers.

OUR BACKGROUND

A commercial mailing house, located in our 11,000 square foot headquarters in Melbourne, Florida. We were founded in 1983 and incorporated in 1991, and have served our customers for over 30 years.

WHY CHOOSE US

The benefits of using Bill My Way go beyond cost cuts to make you more efficient and off-load repetitive tasks. For over thirty years we’ve been refining the billing process for our clients. We are super-efficient at billing. It’s what we do.

Lastest Articles

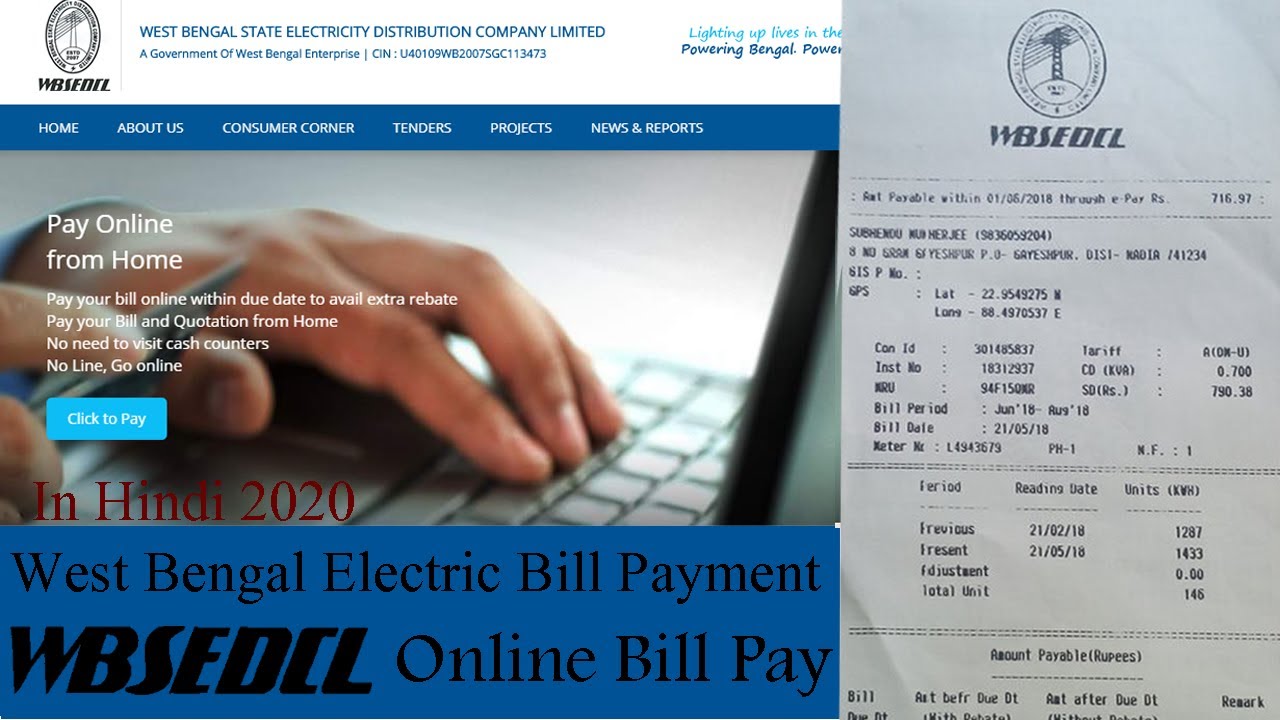

Simplifying Electricity Bill Payment in West Bengal: A Complete Guide

Paying your electricity bill in West Bengal just got a whole lot easier. The West Bengal State Electricity Distribution Company Limited (WBSEDCL) has introduced several convenient options to make bill payment a breeze. As a resident of West Bengal, staying on top of your electricity payments is important. Failure to pay your bill by the … Read more

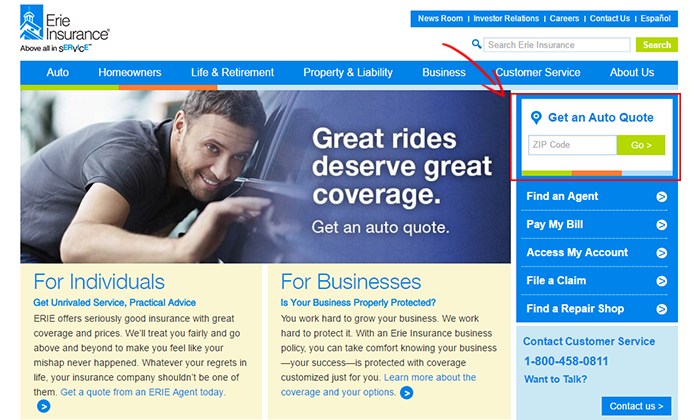

Your Complete Guide to Erie Insurance Payment Options

Are you an Erie Insurance customer looking to make a payment? You’ve come to the right place! In this comprehensive guide, we’ll walk you through all the available payment options offered by Erie Insurance, ensuring a hassle-free experience for you. Let’s dive in! Paying Your Erie Insurance Bill: A Seamless Experience At Erie Insurance, they … Read more

The Easiest Ways to Pay Your Xfinity Bill Online

Paying your monthly Comcast Xfinity bill doesn’t have to be a hassle. With a range of convenient online and mobile options, you can pay your Xfinity bill in just a few quick taps or clicks. As an Xfinity customer myself, I find paying online to be a breeze. In this article, I’ll walk through the … Read more

How to Contact Con Edison to Pay Your Bill

Paying your Con Edison bill on time each month is important to avoid late fees and potential service interruption. Fortunately, Con Edison offers multiple ways to pay your bill conveniently Here is a complete guide on the various methods to contact Con Edison for bill payment Pay Online The fastest and most convenient way to … Read more

How to Pay Your Caseyville Township Sewer Bill Easily

Paying your sewer bill to Caseyville Township doesn’t have to be a hassle. With multiple convenient payment options you can easily pay your sewer bill every month. In this guide I’ll walk you through all the ways you can pay your Caseyville Township sewer bill, so you can choose the method that works best for … Read more

How to Pay a Disconnected Verizon Bill in 5 Easy Steps

Having your Verizon service disconnected can be extremely frustrating. But don’t worry, paying your past due balance and getting reconnected is totally doable if you follow these 5 simple steps. 1. Log In to My Verizon The first thing you’ll need to do is log in to your My Verizon account online This is where … Read more