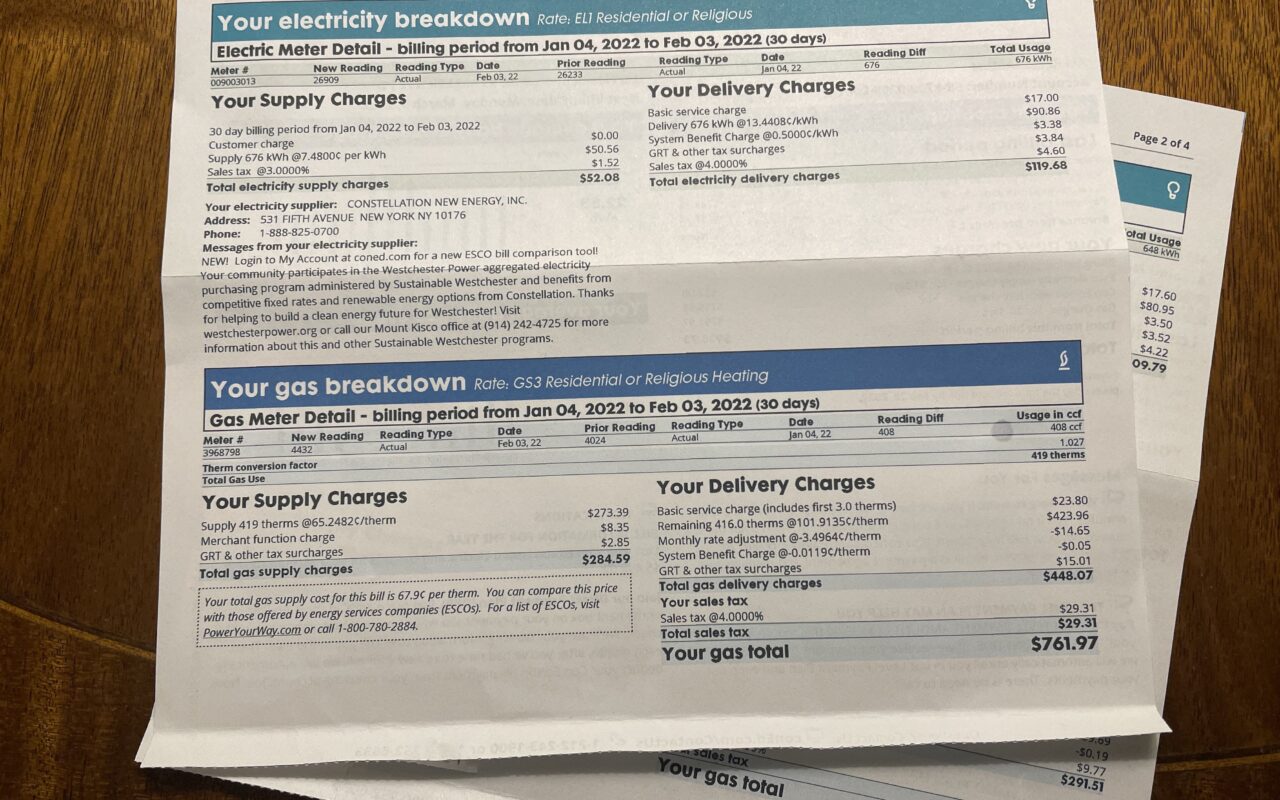

How to Contact Con Edison to Pay Your Bill

Paying your Con Edison bill on time each month is important to avoid late fees and potential service interruption. Fortunately, Con Edison offers multiple ways to pay your bill conveniently Here is a complete guide on the various methods to contact Con Edison for bill payment Pay Online The fastest and most convenient way to … Read more