Paying bills online can be convenient, but you need to ensure any bill pay service is legitimate and secure. Doxo bills itself as an easy way to consolidate paying all your monthly bills in one place online and via mobile. But with growing reports of issues like failed payments, unauthorized withdrawals, and account linking problems, is Doxo bill pay safe to use?

In this comprehensive guide, we’ll cover everything you need to know about Doxo, including:

- How Doxo bill pay works

- The potential pros of using Doxo

- The possible cons and risks to be aware of

- Doxo’s reputation, reviews, and complaints

- Is Doxo ultimately a legitimate and safe bill payment option

- Tips for using Doxo bill pay safely if you decide to try it

Overview: What is Doxo and How Does it Work?

Doxo is an online bill payment service founded in 2008 and based in Bellevue, Washington. Their stated goal is to “simplify bill payment for everyone” by allowing you to see, pay, and track all your monthly bills in one consolidated place either online or via mobile app.

Here’s a quick rundown of how Doxo works:

-

Consolidate bills You can add billers to your Doxo account either by searching their database or entering details manually. All your bills are then accessible in one dashboard

-

Get reminders: Doxo will send you reminders when bills are coming due to help you avoid late fees.

-

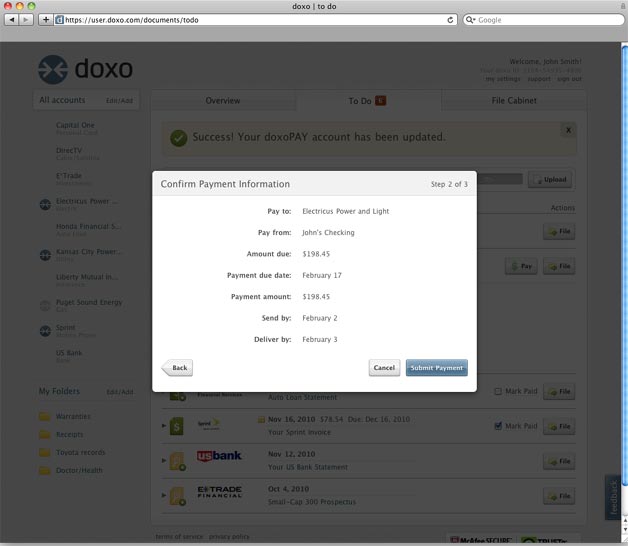

Pay bills: You can pay bills directly through Doxo using your bank account, debit card, or credit card. They also offer AutoPay to pay bills automatically each month.

-

Store records: Doxo keeps your payment history and bills on file so you can access them anytime.

-

Mobile access: Doxo has iOS and Android apps so you can manage bill pay on the go.

-

doxoPLUS upgrade For $599/month, you can upgrade to doxoPLUS to get features like overdraft protection, identity theft alerts, and credit score tracking

The main appeal is having all your bills consolidated in one place that you can access anytime. Doxo aims to simplify bill management through automation.

The Potential Pros of Using Doxo for Bill Pay

There are some advantages that a service like Doxo can offer compared to paying bills individually:

-

Convenience: All your bills and payment history are in one place online or mobile. No need to hunt down statements or remember multiple logins.

-

Avoid late fees: Doxo’s reminders can prevent you from forgetting a bill and incurring penalties. No more last minute scrambling.

-

Time savings: Doxo can save you time spent organizing bills and paperwork every month. Automating payments also saves time.

-

Paperless billing: Doxo stores everything digitally to reduce clutter and help the environment.

-

Cash flow control: Seeing all bills in one dashboard allows you to better track expenses and cash flow.

-

Bill negotiation assistance: Doxo provides tools to help negotiate bills like cable and wireless plans to potentially lower costs.

-

Budgeting tools: Doxo can analyze spending patterns and make customized recommendations to help cut costs and stick to a budget.

For those who find bill management a hassle, Doxo provides a simplified, consolidated solution. The convenience and automation aspects can be very appealing to busy households.

The Potential Risks and Downsides of Doxo Bill Pay

However, there are also some potential cons and risks to consider with Doxo:

-

Service fees: While Doxo is free to join, you’ll pay $1.99 per electronic payment. To avoid fees, you need to upgrade to doxoPLUS at $5.99/month.

-

Account security: Giving Doxo access to your bill accounts could pose a security risk, especially if they have your login info. Use unique passwords as an added precaution.

-

Personal data collection: Doxo may gather a significant amount of personal data from your bills and payment transactions. Be sure to review their privacy policy.

-

Reliability issues: Many reviews cite problems with Doxo incorrectly calculating bill amounts or failing to send payments, potentially leading to late fees.

-

Lack of biller support: Most billers don’t directly partner with Doxo, so there’s little recourse if payments go wrong. You may need to contact your billers directly.

-

Account management difficulties: Getting statement copies or making account changes often must be done directly with the biller instead of through Doxo.

-

Potential overdrafts: Doxo draws money right from your linked bank account, so an incorrect or duplicate payment could overdraw your account.

For some consumers, the risks and hassles may outweigh the convenience Doxo offers. As we’ll explore next, Doxo complaints also raise some red flags.

Doxo’s Reputation: Key Reviews and Common Complaints

It’s important to research a financial services company’s reputation before entrusting them with your bills and payment details. Here’s a summary of Doxo’s key reviews and complaints:

-

Trustpilot reviews: Doxo has a 4 out of 5 star rating based on over 500 reviews. 73% are 5-star, while 13% are 1-star. Positive feedback focuses on convenience and reminders. Negative reviews cite failed payments and poor customer service.

-

Better Business Bureau (BBB): Doxo has a B+ rating with the BBB but also 356 closed complaints over 3 years, mostly regarding billing issues.

-

Consumer Financial Protection Bureau (CFPB): Over 130 CFPB complaints have been filed against Doxo regarding incorrect charges, poor service, and unauthorized payments.

-

Common complaints: The most frequent complaints across reviews include inaccurate or failed payments leading to late fees, unauthorized bank account withdrawals, account linking problems, and poor customer service resolving errors.

Is Doxo Ultimately a Legitimate and Safe Bill Pay Service?

Given this background, is Doxo a trustworthy and safe option for paying your bills? Here are a few key points to help determine if Doxo may be right for your needs:

-

Doxo is a real business founded in 2008 that services over 10 million users. They offer a legitimate service, but may have issues with reliable execution.

-

They are BBB accredited with a B+ rating, although they also have hundreds of complaints. The BBB accreditation lends some legitimacy.

-

Doxo does not directly partner with most billers. This likely contributes to the higher error rates and poor customer service.

-

The FTC has not taken legal action against Doxo for fraud or scams, though they have received consumer complaints.

-

While reviews cite problems, many users do successfully use Doxo without major issues. Your risk depends on your specific billers.

-

Use caution providing Doxo your bank login credentials and consider linking small, non-critical bills first to test reliability.

-

The doxoPLUS subscription at $5.99/month may provide improved accuracy and support vs. the free plan.

Tips for Safe and Smooth Bill Pay with Doxo

If you decide to try Doxo for bill pay, here are some tips for the best experience:

-

Start by paying 1-2 small bills like cell phone or internet to test reliability before adding larger, critical bills.

-

Use unique complex passwords for your Doxo account and updated passwords for linked biller accounts.

-

Frequently review Doxo payments to ensure correct amounts are being debited and spot errors immediately.

-

Confirm with billers that Doxo payments are arriving on time each month. Follow up if bills show late.

-

If possible, don’t let Doxo store your bank/biller login credentials for added security. Manually approve payments.

-

Browse Doxo’s FAQs and support articles to avoid fees, properly link accounts, and handle errors.

-

Promptly contact Doxo support if payments fail or issues arise. Escalate to billers and your bank if needed.

-

Be cautious of phishing emails pretending to be Doxo. Only log in through their website and watch for scams.

-

Consider upgrading to the paid doxoPLUS plan for higher payment limits, overdraft protection, and priority support.

-

Carefully review Doxo’s pricing and policies before upgrading subscription plans.

The Bottom Line

While Doxo offers a convenient centralized bill payment service, be cautious of potential reliability issues resulting in late fees or overdrafts. Start slowly and use unique passwords and vigilance. Weigh the pros and cons carefully based on your situation. With prudent precautions, Doxo can simplify bill pay – but

Consumers have had their gas, water, and electricity cut off because of Doxo’s practices, U.S. regulators say

Doxo, a relatively unknown bill payment platform, has allegedly been deceiving and scamming consumers for years through deceptive online marketing and shady business practices.

On Thursday, the U.S. Federal Trade Commission (FTC) sued Seattle-based Doxo and its founders, Steve Shivers and Roger Parks, accusing the firm of ignoring tens of thousands of complaints from consumers and billers about their business model.Advertisement

“Doxo intercepted consumers trying to reach their billers and tricked them into paying millions of dollars in junk fees,” Samuel Levine, who leads the FTC’s bureau of consumer protection, said in a statement. Advertisement Advertisement

Here’s how it works.

Doxo places ads to “intercept” consumers trying to visit their billers’ websites by stylizing ads to impersonate the billers. The company claims customers can “pay any bill” using its “network” of billers. But according to the FTC, Doxo has no relationship with more than 98% of billers in the so-called network. Advertisement

If the consumer continues past clicking on the ad to the payment process, Doxo adds extra junk fees to the bill, including a “delivery fee” that first appears on the final page of a seven-step process. In most cases, those fees could have been avoided if the consumer had gone to the actual biller. The FTC alleges that people have been mistakenly forced to pay millions of dollars in junk fees because of Doxo.

And, although Doxo charges consumers instantly, the biller doesn’t get paid until later. The FTC says that, in “many instances,” Doxo prints out a paper check that arrives days or weeks after a customer thinks their bill has already been paid. Advertisement

“Consumers have spent hours trying to track down payments made to Doxo, have missed tax, child support, and utility payments, have had medical and other bills sent to collection, and have had their gas, water, and electricity cut off, all because Doxo falsely represented that their payments were made ‘directly’ to their billers,” the FTC wrote in its complaint.

In addition to the one-time junk fees, Doxo tricked some consumers into a subscription package, according to the FTC. If consumers clicked on a terms of service hyperlink at the bottom of the payment page, Doxo automatically enrolled them into a paid subscription — without notifying them of the change. Advertisement

Several consumers told the FTC they were tricked into believing that paying through Doxo’s services was the only way to make an online payment. Others thought their biller preferred consumers pay through Doxo because of the pop-up search ads.

Doxo provided Quartz with a statement calling the investigation “inaccurate, and unjust.” Its full statement reads:

Some companies, including several hospitals and local governments, have dedicated webpages warning consumers not to use Doxo thanks to how widespread its presence has become. Shivers, Doxo’s CEO, testified in March 2021 that his company has received 58 complaints from state agencies.

In March 2022, WRAL reported that consumers in North Carolina were forced to pay $100,000 worth of late fees to the state’s toll authority because of delayed payments made through Doxo. Parks, who serves as Doxo’s vice president, replied by accusing a toll authority spokesperson of defamation, according to the FTC.

Welcome to doxo – The Simple, Secure Way to Pay Your Bills

FAQ

Is doxo a safe site?

What is the issue with doxo?

Is doxo payment safe?

What companies use doxo?

Is doxo a legit water bill paying service?

My water bill requires you to pay by mail and I was out of checks, so I googled them and the first result was from doxo which says it’s a paperless bill paying service. It had all the info for the utility and seemed legit, so I scheduled a payment.

Is doxo a scam?

Doxo is a real business founded in 2008 that services over 10 million users. They offer a legitimate service, but may have issues executing it reliably. They are BBB accredited with a B+ rating, despite also having hundreds of complaints. The BBB name provides some legitimacy. Doxo does not directly integrate with most billers.

Does doxo charge a consumer for payment?

The FTC’s complaint notes that, even though doxo immediately charges a consumer for payment, in many instances, the company then prints a paper check that is mailed to the biller – arriving days or sometimes weeks after the customer believes their bill is paid.

Does doxo have a payment ‘network’?

Less than 2% of the billers in Doxo’s purported payment ‘network’ have authorized Doxo to receive payments on their behalf.” What’s more, the FTC says that in many instances, consumers could have paid their bills directly to the actual companies without incurring any additional charges, including the “Payment Delivery Fee” that Doxo pocketed.

What are the downsides of doxo bill pay?

However, there are also some downsides to consider with Doxo bill pay: Service fees: While Doxo is free to join, you’ll pay service fees of $1.99 per electronic bill payment. To avoid fees, you need to upgrade to their premium doxoPLUS plan at $5.99/month.

How much does doxo cost?

Service fees: While Doxo is free to join, you’ll pay service fees of $1.99 per electronic bill payment. To avoid fees, you need to upgrade to their premium doxoPLUS plan at $5.99/month. Account security: Giving any service access to your bill accounts could be a security risk, especially if they have your login credentials.