Keeping your Safety Insurance payments up to date is important to maintain your policy coverage. Safety offers quick and easy online bill payment options to fit your needs. This comprehensive guide will walk through the various ways you can pay your Safety Insurance bill online.

Overview of Online Payment Options

Safety makes paying your bill convenient through several online methods

- Pay through MyAccount portal

- Use QuickPay without logging in

- Enroll in recurring AutoPay

- Pay by phone

- Pay by mail

- Pay in person at authorized agents

Read on for details on each payment method.

Pay Through MyAccount Portal

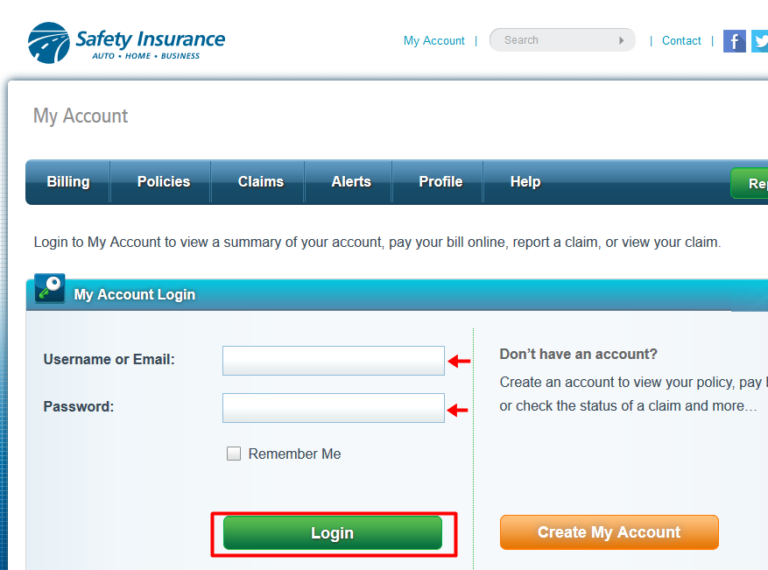

The fastest way to pay is by logging into your MyAccount portal online or via the mobile app.

Go to SafetyInsurance.com and click on “My Account” to sign in.

Select “Pay Bill”, choose payment amount, and submit. Use a card or e-check.

Pay Without Logging In

Don’t want to sign into your account? Use Safety’s QuickPay option to make a fast one-time payment.

Go to SafetyInsurance.com/QuickPay and enter your policy number and zip code.

Select payment amount, enter payment details, review, and submit.

Enroll in AutoPay

For automated payments, sign up for AutoPay through your MyAccount portal.

Payments will automatically deduct from your bank account on your due date each month.

Under “My Profile”, turn on AutoPay and enter your bank account information.

Pay by Phone

Call Safety Insurance at 1-800-951-2100 and speak to an agent to make a payment.

Let them know you want to pay your bill or set up recurring payments. Provide account details.

You can pay by credit card, debit card, or bank account over the phone.

Pay by Mail

To pay by mail, send a check or money order to:

Safety Insurance

PO Box 55089

Boston, MA 02205

Include your policy number on the check. Allow 5-7 days for arrival and processing.

Pay in Person

Take your bill to an authorized Safety Insurance agent location to pay in cash.

Find agent locations on SafetyInsurance.com.

In-person payments allow same-day processing to avoid late fees.

Check Payment History

Through your online MyAccount portal, you can view payment history to confirm processing.

Under “My Profile”, select “Payment History” to see past transactions, amounts, and dates.

Review regularly to catch any discrepancies and ensure proper billing.

Update Billing Information

If your address changes, log into your MyAccount to update your contact information.

Under “My Profile”, edit your personal details. This ensures bills and notices go to the right place.

You can also update payment methods here when card numbers change.

Avoid Late Fees

Safety Insurance bills are due the same date each month, outlined on your statement.

Pay early or on time to avoid late fees, which can be as much as $50 per policy.

Set calendar reminders so your bill never slips through the cracks each month.

Understand Billing Cycles

Safety bills one month ahead, meaning your current bill covers the next month of policy coverage.

Review your billing date, due date, and coverage periods to understand your payment cycle.

Knowing dates helps you pay accurately and on time each month.

Get Account Support

Have questions or need help with your policy? Contact Safety Insurance customer support.

Call 1-800-951-2100 or start a live chat through your online account portal.

Support agents can assist with billing details, payments, and coverage questions.

Review Plan Options

If your premium is difficult to manage, you may be able to reduce costs by adjusting your policy.

Discuss options with your agent during renewal periods to change deductibles, coverage limits, and other details.

Modifying your policy could potentially lower your monthly premium amount.

Bundle Home and Auto

If you have home and auto policies with Safety, consider bundling them together on one bill.

Bundling policies can save up to 20% on your overall insurance costs through multi-policy discounts.

Simpler billing, lower rates, and better coverage make bundling an appealing option for many policyholders.

Pay Off Balance Each Month

Safety bills require paying your new account balance in full each month to avoid penalties.

Carrying an unpaid balance month-to-month can incur late fees and cancellation.

Review your monthly statement and pay the total balance due on time to stay current.

Spread Out Down Payment

If the 6-month down payment is a financial stretch, ask your agent about spreading it over 3 installments.

This lets you make a smaller down payment upfront, then pay the remaining balance over the next 2 months.

Breaking up the down payment makes onboarding new policies more affordable.

In Summary

Paying your Safety Insurance bill swiftly each month is easy and convenient online. Use your account portal, AutoPay, QuickPay and more to maintain an active policy. Contact Safety Insurance anytime for account assistance and support. Keeping payments current provides peace of mind that your important coverage remains intact.

Log in to set reminders

Sign up for email reminders to know when your insurance bill is due.

Make paper cuts and fumbling through stacks of paper an ancient memory with paperless billing.

Put paying your bills on easy mode

AutoPay takes the hassle out of paying your bill.