Paying bills can be a tedious task. From utility bills to credit card bills, it often feels like the bills never stop coming. However, if you have American Express Membership Rewards points, you can actually use them to pay many of your bills. This clever trick allows you to put your hard-earned points to good use. In this comprehensive guide, I’ll explain everything you need to know about using Amex points to pay bills.

How Amex Pay With Points Works

The Amex Pay With Points program allows you to redeem your Membership Rewards points to cover eligible charges on your monthly Amex statement. Here’s a quick 3-step overview of how it works:

-

View Eligible Charges Log into your Amex account online and view your recent charges Amex will highlight which charges are eligible for Pay With Points,

-

Select Charges to Cover: Simply check the boxes next to the charges you want to pay with points. A checkmark will appear indicating your selection.

-

Redeem Points: Click the “Redeem Now” button. Amex will deduct the points from your account and apply a statement credit within 48 hours.

It’s an incredibly easy way to wipe charges off your bill using points instead of cash. The credits even show up as separate line items on your statement for record keeping.

What Charges Are Eligible?

Amex states that any charge that meets the following criteria is eligible for Pay With Points

- The charge occurred in the US or a US territory

- The charge is at least $1

- The charge shows up on your recent activity or current statement

- The charge has never been disputed

In practice, this covers a wide variety of common bills:

- Cell phone bills

- Internet and cable bills

- Electricity and utility bills

- Insurance premiums

- Credit card bills

- Rent payments

- Mortgage payments

- And more!

As you can see, Pay With Points gives you tons of flexibility in terms of which bills you can pay with Amex points. Any vendors that accept Amex cards are likely fair game.

How Many Points Do You Need?

To use Pay With Points, you’ll need at least 1,000 Membership Rewards points in your account. The good news is that points go a long way. Generally, you’ll get around 1 cent per point in value when redeeming this way.

You can also choose to split payments between points and your card. So even if you only have 500 points, you could cover half of a $50 bill by redeeming those 500 points.

Maximizing the Value of Amex Points

While 1 cent per point is decent, you can potentially get even more value from your Amex points depending on which card you have.

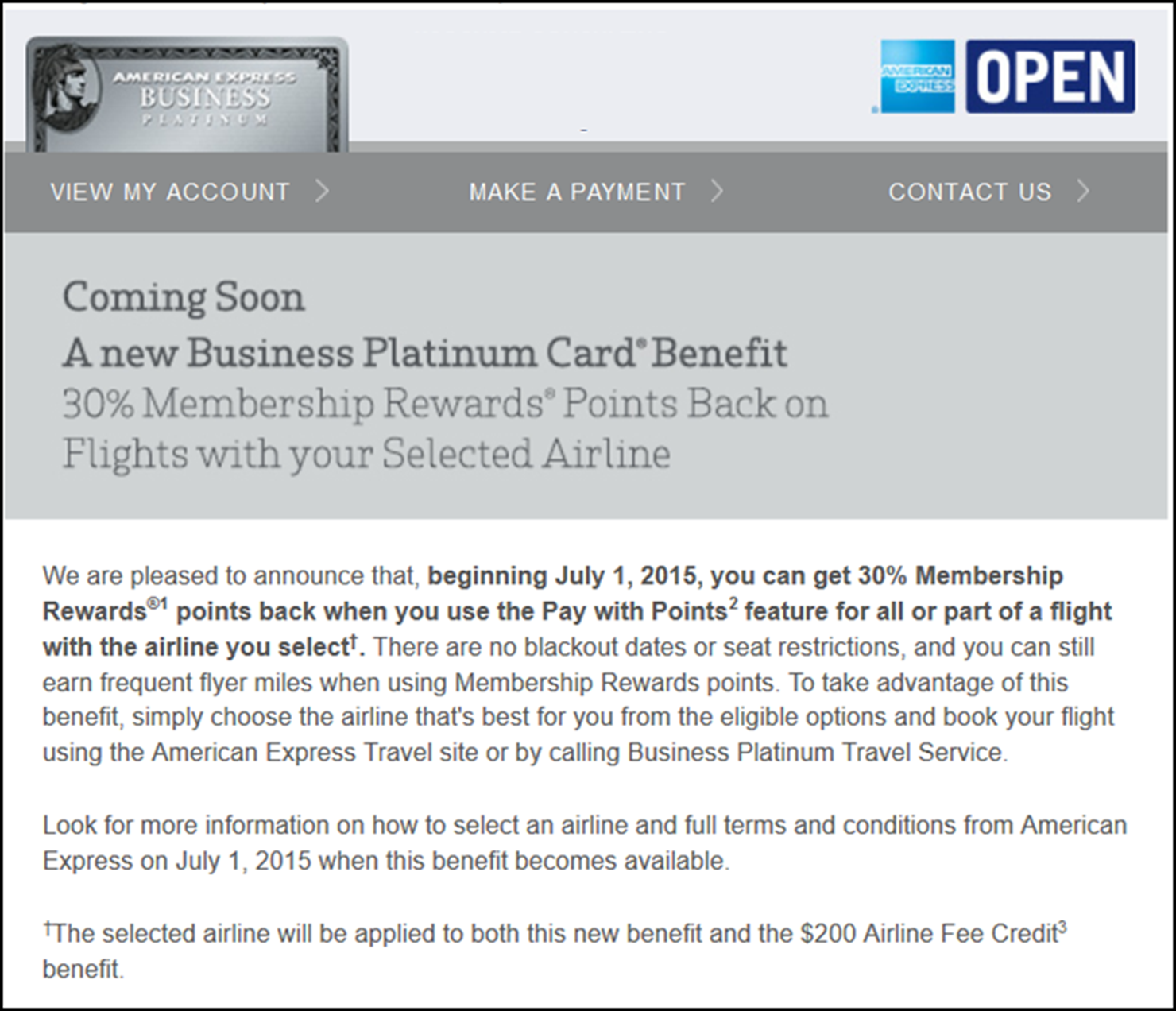

The Business Platinum, Business Gold, and Business Centurion cards from American Express offer point rebates of 35%, 25%, and 50% respectively when you use Pay With Points to book airfare.

This can boost the value of your points to over 2 cents each in some cases! The rebates apply automatically whenever you use points to book flights with Amex Travel.

So by using Pay With Points for bills instead of cash back or gift cards, you can save your points for when you really need them – like booking award travel.

Pay With Points vs Amex Offers

One alternative to Pay With Points is using Amex Offers. These targeted deals allow you to earn statement credits at select merchants when you meet spending requirements.

The main difference is that Amex Offers don’t require you to redeem points. The statement credits are automatically applied when the terms are met.

However, Pay With Points tends to provide more flexibility since you can use it on any eligible charge. Amex Offers are limited to specific merchants that happen to be running promotions.

So Pay With Points is better for one-off bills, while Amex Offers work well for recurring expenses like cell phone bills if that merchant has an applicable offer.

Drawbacks to Pay With Points

While using points for bills is often a good value, there are a couple potential drawbacks to consider:

-

You don’t earn additional points on Pay With Points purchases. If you paid the bill with your card instead, you’d rack up points.

-

Transferrable points are generally best used for high value airline and hotel redemptions. Bill pay may not maximize their upside.

As a result, Pay With Points is best used in moderation as part of a balanced redemption strategy. High value transfers should still be your top priority for most points programs.

Steps To Use Pay With Points

If you want to put your Amex points to work on bills, here are the simple steps:

-

Log into your Amex account online.

-

Select “Pay with Points” from the menu or account homepage.

-

Toggle over to the “Cover Charges” tab.

-

Check the boxes next to any eligible charges you want to pay with points.

-

Verify the point totals, then click “Redeem Now”.

That’s all there is to it! The statement credit will post to your account within a couple days. Just like that, you’ve turned points into cash back towards bills.

Can You Use Pay With Points In-Person?

Unfortunately Pay With Points cannot be used directly for in-person or point of sale transactions. The feature is limited to online statement credits only.

However, you can use your regular Amex card for in-person bills and purchases as normal. Then simply log in later and redeem points to offset those charges. This achieves essentially the same effect as paying directly with points.

Is Pay With Points Worth It Overall?

Being able to redeem points for any charge on your statement is an incredibly flexible option. Whether you are short on cash one month or just want to use up extra points, Pay With Points enables you to cover bills in a pinch.

While the 1 cent per point return is not exceptional, it’s an easy way to knock out expenses while saving cash. The airline point rebates on certain Amex business cards can also drive up the value substantially.

Just be sure not to make Pay With Points your only redemption method. Taking advantage of transfer partners and card perks will maximize your points in the long run. But as part of a balanced approach, Pay With Points is definitely worth considering.

So next time you log in to pay that monthly credit card bill, see if you have some Amex points to put towards it instead. Doing so is a simple way to get additional mileage out of your hard-earned rewards.

Cards that offer a Pay with Points bonus

As mentioned, there are three Amex cards for small businesses that offer a rebate when you pay with points (terms apply). Here are their current welcome offers and other details:

- The Business Platinum Card from American Express: Earn 150,000 points after you spend $20,000 on eligible purchases with your card within the first three months of card membership.

- American Express® Business Gold Card: Earn 100,000 bonus points after you spend $15,000 on eligible purchases in the first three months of card membership.

- Centurion Business Card from American Express: Applications by invitation only.

The information for the Centurion Business card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

| Details | Business Centurion | Business Platinum | Business Gold |

|---|---|---|---|

| Pay with Points rebate | 50% | 35% | 25% |

| Value of each redeemed point | 2 cents | 1.54 cents | 1.33 cents |

| Eligible flights | All flights | First- and business-class flights, and economy flights on your selected airline | First- and business-class flights, and economy flights on your selected airline |

| Maximum number of bonus points | N/A | 1 million points per calendar year | 250,000 points per calendar year |

How to use Amex Pay with Points

Its very easy to take advantage of the American Express Pay with Points feature to book your flight. First, sign in to your Amex account and then search for flights through the Amex Travel portal as you normally would. At checkout, select either “Use only points” or “Use points + American Express card” to apply some or all of your points.

When paying with points, your card will be charged the full dollar amount. Amex will then, within 48 hours, add a statement credit for the portion of the flight that you paid for with points.

Bear in mind that the rebate offered by some cards isnt an outright discount. So, if you have an eligible card, you must still have the full amount of points in your account at the time of booking. WALLACE COTTON/THE POINTS GUY

For instance, Ive redeemed 121,850 points to cover the cost of a $1,218.50 Cathay Pacific business-class ticket from Male, Maldives (MLE) to Shanghai (PVG). I initially redeemed the points at a rate of 1 cent each, but thanks to The Business Platinum Card® from American Express, once I received my 35% rebate of 42,647 points, my effective redemption value jumped from 1 cent per point to 1.54 cents. The math is a little confusing, but if you divide 1 by 0.65 (the percent I pay after the rebate), you get 1.54.

Not every booking offers a rebate — unless you have the elusive Business Centurion Card from American Express. With the other two cards, first- and business-class flights on any airline count, but only economy flights on a specific airline that you select each year are also eligible for the rebate. There are also calendar-year maximums of the number of rebated points you can expect each year, depending on your card.

Finally…How to Easily Redeem American Express Points (for MAX Value)

FAQ

Can you use Amex reward points to pay your bill?

Can I use Amex points to pay?

Can I use my rewards points to pay my bill?

Can you use Amex points to pay the fee?

How do I use American Express Pay with points?

It’s very easy to take advantage of the American Express Pay with Points feature to book your flight. First, sign in to your Amex account and then search for flights through the Amex Travel portal as you normally would. At checkout, select either “Use only points” or “Use points + American Express card” to apply some or all of your points.

How do I use Amex points?

First, sign in to your Amex account and then search for flights through the Amex Travel portal as you normally would. At checkout, select either “Use only points” or “Use points + American Express card” to apply some or all of your points. When paying with points, your card will be charged the full dollar amount.

Does American Express Pay with points offer a better value?

Sometimes, it’s possible to get a better value by using the American Express Pay with Points feature than you’d get by transferring your points. Because certain Amex cards provide a rebate on the number of points you need for eligible Pay with Points flight redemptions, having the right cards in your wallet can unlock some excellent value.

What happens if I pay with Amex points?

When paying with points, your card will be charged the full dollar amount. Amex will then, within 48 hours, add a statement credit for the portion of the flight that you paid for with points. Bear in mind that the rebate offered by some cards isn’t an outright discount.

Can I use American Express points online?

Account managers and Rewards managers may be eligible to use points by calling the number on the back of your Card but are not eligible to use points online. 3. Available Charges American Express will present the eligible charges you can use points towards, and we may change which charges are eligible at any time without notice.

How do I use my American Express membership rewards® points?

Earning American Express Membership Rewards® is easy, but knowing how to use your points in an effective way can be hard. From travel partner transfers, flight or hotel bookings, and gift cards to statement credits, the number of redemption options can be overwhelming.